Options strike price calculator

Volatility Risk Free Rate pa. This is calculated as the 60 stock price minus the 50 option strike price minus the 3 purchase price times 100 because each options contract covers 100 shares of the.

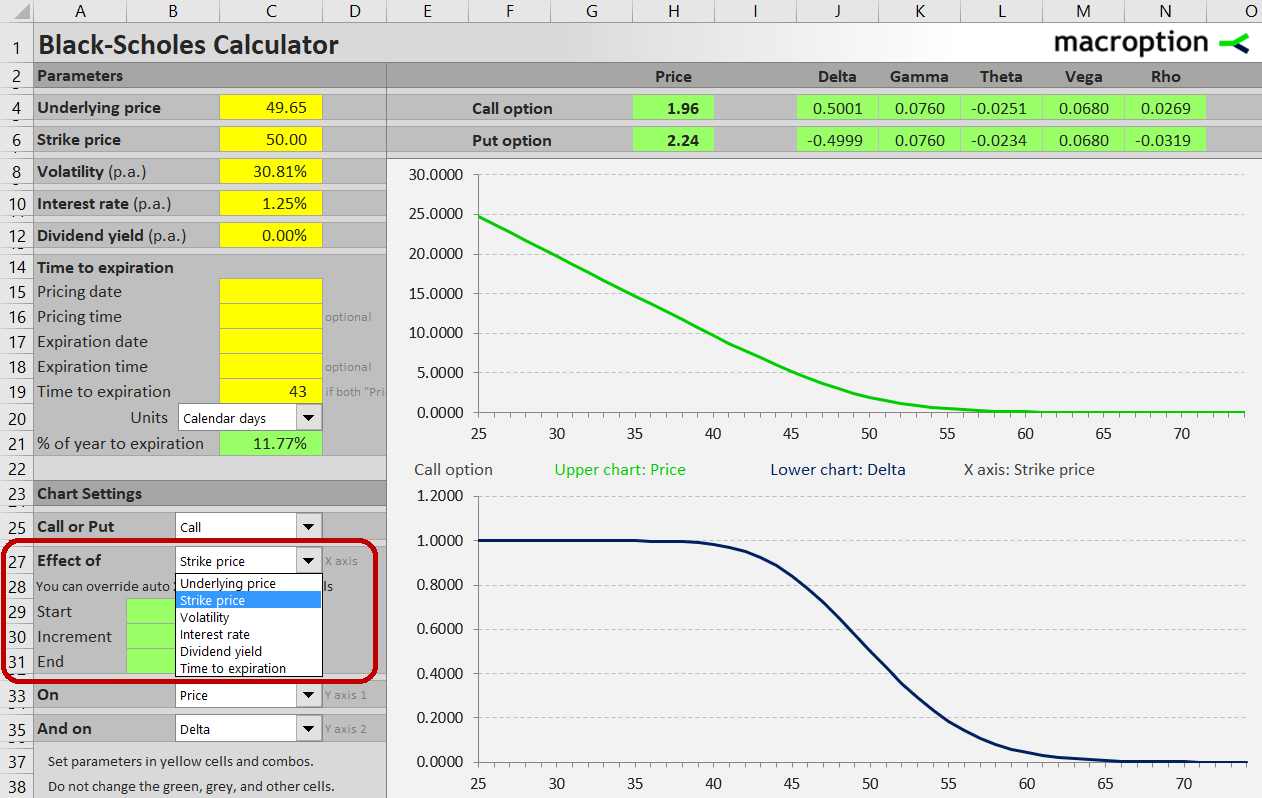

Working With Strike Price In The Black Scholes Calculator Macroption

Strike price in the options is a predetermined price at which the security or any underlying asset can be bought or sold on or before the expiry of the contract.

. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. If the stock price at expiration is less than the strike price the option is worthless. Underlying Volatility Market Price of Option.

Black-Scholes Option Price and Option Greeks. The option premium in general terms for a call option will be lower the farther the strike price is above the underlying price. Calculates Prices of Options.

To start select an options trading strategy. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies.

Stock options are sold in contracts or lots of. That is an option with a strike price of 150 will have a much. In Table 3 it has an intrinsic value of 180 ie the strike price of 29 less the stock price of 2720 and the time value of 039 ie the put price of 219 less the intrinsic.

On this page is an Incentive Stock Options or ISO calculator. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20 Days to. Setting Strike Price Charts.

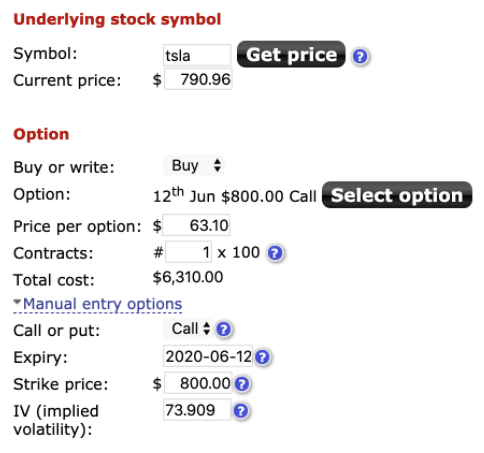

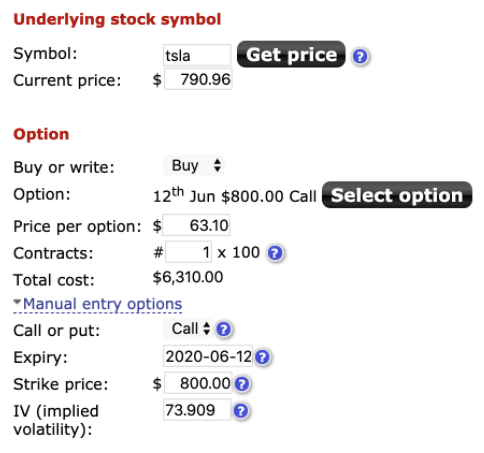

Copies of this document may be obtained from your broker from any. TIME TO EXPIRATION IN DAYS. Options Calculator is used to calculate options profit or losses for your trades.

Nifty Options Trading Calculator Calculate NSE Call Put Option Price Option trading is a highly rewarding way to supercharge your returns. This is the price per a single stock option. The calculator can model effects of strike price selection on call or put option prices or any of the Greeks.

You can quickly determine your options strike price for any stock you are trading using a very simple. The strike price is a threshold to determine the intrinsic value of options. Generate fair value prices and Greeks for any of CME Groups options on futures contracts or price up a generic option with our universal calculator.

This is a library to help calculate options strike price and expiration that you can add to a script i use it mainly for symbol calulation to place orders to buy options on TD ameritrade so it will be. The strike price on the day of. The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest.

Options profit calculator will calculate how much you make and the total ROI with your option positions. Options Warrants Calculator. CONT DIV YIELD 0015 for 15.

Multiply the strike price by 100 to calculate the additional amount youll pay to use the option to buy or sell stock. An Easy free Excel Strike price Calculator is available for download. The option calculator uses a mathematical formula called the Black-Scholes to predict and analyse.

Calculate your options value. Apply 10 correction to. To display a strike price chart select Strike price in.

3 Month 6 Month 1 Year 2 Year 3 Year. Basic Long Call bullish Long. Calculate Fair Values of Call options and Put.

NSE Options Calculator - Calculate NSE Option Price or implied volatility for known option price. Risk Free Rate pa. On Divident Paying Stocks.

INTEREST RATE 01 for 10. Concluding the example multiply 35 by 100 to get 3500. About Terms.

Pricing Options Strike Premium And Pricing Factors Nasdaq

Option Premium Calculation Simplified Try This Shortcut Trick To Find Delta Eqsis Youtube

The Options Industry Council Oic Options Pricing

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Calculating Call And Put Option Payoff In Excel Macroption

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Ivolatility Com Services Tools Analysis Services Basic Live Calculator Live Calculator

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Option Premium Calculator Streamlined And Easy To Use

Call Option Calculator Put Option

Options Profit Calculator Updating An Estimate For An Existing Calculation On Options Profit Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Probability Of A Successful Option Trade

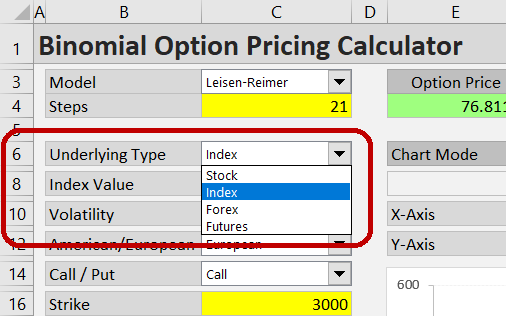

Index Options Binomial Option Pricing Calculator Macroption

Option Price Calculator Calculate Bs Option Price Greeks